Bridgecrest: Manage Your Loan & Get Help | Quick Guide & Tips

Are you ready to take control of your vehicle finances and steer them towards a successful future? Bridgecrest offers a comprehensive platform designed to simplify your auto loan management, providing convenient tools and support every step of the way.

Navigating the complexities of car financing can often feel like traversing a winding road. Payments, account management, and customer service interactions can quickly become a source of frustration. Bridgecrest, however, aims to smooth out the ride, offering a user-friendly experience accessible through its online portal and mobile application.

Whether you're a seasoned driver or new to the world of vehicle financing, understanding the core functions of Bridgecrest's services is essential. The platforms primary goal is to make the often cumbersome process of managing car loans straightforward and stress-free. They want to empower you to take control of your financial journey.

Here's a glimpse into the key aspects of Bridgecrest's service:

Online Account Management: Bridgecrest provides an online portal where you can access your account information, track your payment history, and manage your loan details.

Payment Options: The platform offers a variety of payment options, allowing you to choose the method that best suits your needs and preferences.

- Ophiuchus And Pisces Compatibility

- Tate Mcrae Porn Leaked

- Boosie Fade Latest

- Janko Futura

- Ellsworth Raymond Johnson

Customer Support: Bridgecrest offers assistance when you need it. Customer service representatives are available to answer your questions and help you navigate any challenges you may face.

Mobile Accessibility: With the Bridgecrest app, you can manage your vehicle account payments on the go, providing convenient access to your finances from your mobile device.

BBB Rating: Bridgecrest is rated A+ by the Better Business Bureau (BBB), reflecting its commitment to customer service and ethical business practices.

To delve deeper into the specifics of managing your Bridgecrest account, understanding how to access and utilize the online features is paramount.

Accessing Your Account:

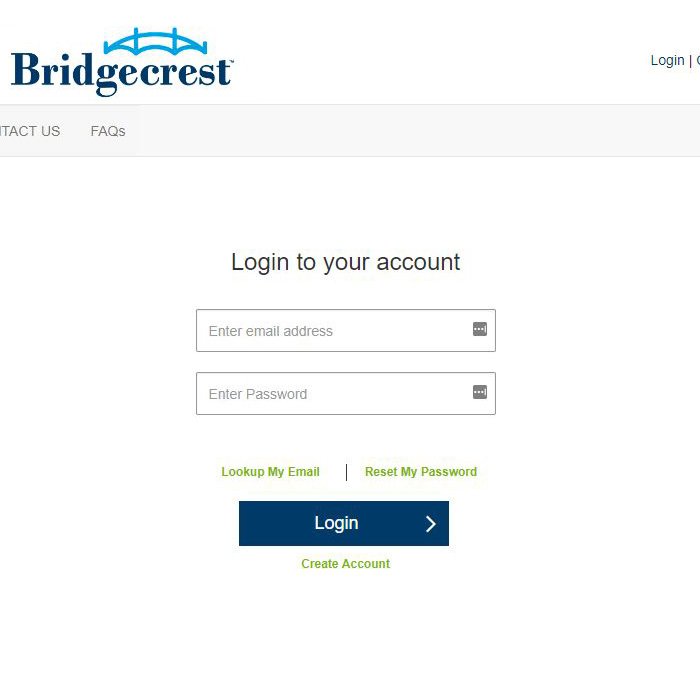

To access your account, you will need to visit the Bridgecrest website, which is bridgecrest.com. There, you will be prompted to login.

Login Process:

To login, you'll typically need your username and password. Once logged in, you'll be able to access your account information.

Key Functions within the Account:

Once logged in, you will be able to view payment options, check your payoff amount, and get in touch with customer service.

Checking Your Payoff Amount:

To check your payoff amount, log in to your Bridgecrest account. On a mobile device, the payoff button will typically appear in the middle of the page. On a desktop, look near the bottom of the page for the 'get a payoff quote' link.

Contacting Customer Service:

Bridgecrest offers multiple avenues for contacting customer service. You can usually find contact information, such as phone numbers or email addresses, on their website.

However, some users have reported challenges in getting specific issues resolved. A user who paid off their Carvana car loan through Bridgecrest says their account was deleted and they could not get proof of payoff or title. They tried to contact Bridgecrest, Carvana, and the MVC but got no help or updates. While this represents an isolated incident, it's an essential consideration for potential users.

For those seeking a more convenient method of managing their loan, the Bridgecrest app is a useful tool. It offers:

On-the-Go Access: The app allows you to manage your vehicle account payments from your mobile device.

Payment Management: You can make payments, view payment history, and manage your loan details through the app.

The integration of Bridgecrest with Carvana highlights the evolving landscape of car financing and purchasing. The partnership offers streamlined financing options for those buying vehicles through Carvana's online platform.

Carvana and Bridgecrest:

Financing and bridgecrest & the online shopping experience @carvana | skip the dealership & buy online @ carvana.com & the online shopping experience @carvana | skip the dealership & buy online @ carvana.com

In essence, Bridgecrest is designed to be a comprehensive financial partner in the realm of vehicle ownership, simplifying loan management and providing resources for customers. While there are always areas for improvement, Bridgecrest's platform and services are designed to offer a user-friendly, streamlined experience.

To summarize the key benefits:

Ease of use: Bridgecrest aims to make it easy to manage your account online, find convenient payment options, and get assistance when you need it.

Convenience: The mobile app allows for on-the-go access to your account.

Accessibility: Customers can login to their Bridgecrest account to see payment options and get in touch with the customer service.

BBB Rating: Bridgecrest is rated A+ by the Better Business Bureau (BBB), reflecting its commitment to customer service and ethical business practices.

Article Recommendations

- Kevin Gates Rapper Biography

- Joe Gatto Misconduct

- Olloflix

- Ellsworth Raymond Johnson

- Renee Rapp Nudes

Detail Author:

- Name : Elyssa Rolfson

- Username : destini.willms

- Email : hank28@hotmail.com

- Birthdate : 2000-11-17

- Address : 92888 Summer Fords Apt. 324 Wiegandfort, MO 52232

- Phone : +1-571-476-3972

- Company : Oberbrunner, Howe and Towne

- Job : Central Office Operator

- Bio : Quasi iste laboriosam illo nisi laborum qui. Harum rerum ducimus corrupti sint. Voluptas sapiente alias est rerum fuga sed consequuntur.

Socials

facebook:

- url : https://facebook.com/jadyn_schaefer

- username : jadyn_schaefer

- bio : Et iusto est perspiciatis deleniti mollitia.

- followers : 4221

- following : 445

linkedin:

- url : https://linkedin.com/in/jadynschaefer

- username : jadynschaefer

- bio : Et nihil facere sed cumque eum.

- followers : 2866

- following : 757